Welcome to the Accounting Chapter 10-9 Answer Key, your definitive guide to understanding the intricacies of accounting and financial analysis. This comprehensive resource unravels the complexities of the balance sheet, financial ratios, and working capital management, empowering you with the knowledge to make informed financial decisions.

As we delve into the depths of accounting, we will explore the significance of the balance sheet, unravel the secrets of financial ratios, and master the art of analyzing cash flows. Together, we will navigate the intricacies of inventory management, delve into the nature of long-term assets, and unravel the mysteries of liabilities and equity.

1. Accounting Chapter 10-9

Overview

Chapter 10-9 in accounting covers the analysis and interpretation of financial statements. It provides a comprehensive understanding of the balance sheet, income statement, and statement of cash flows, as well as key financial ratios and their applications. The chapter emphasizes the importance of financial statement analysis in making informed business decisions and evaluating a company’s financial health.

2. Understanding the Balance Sheet: Accounting Chapter 10-9 Answer Key

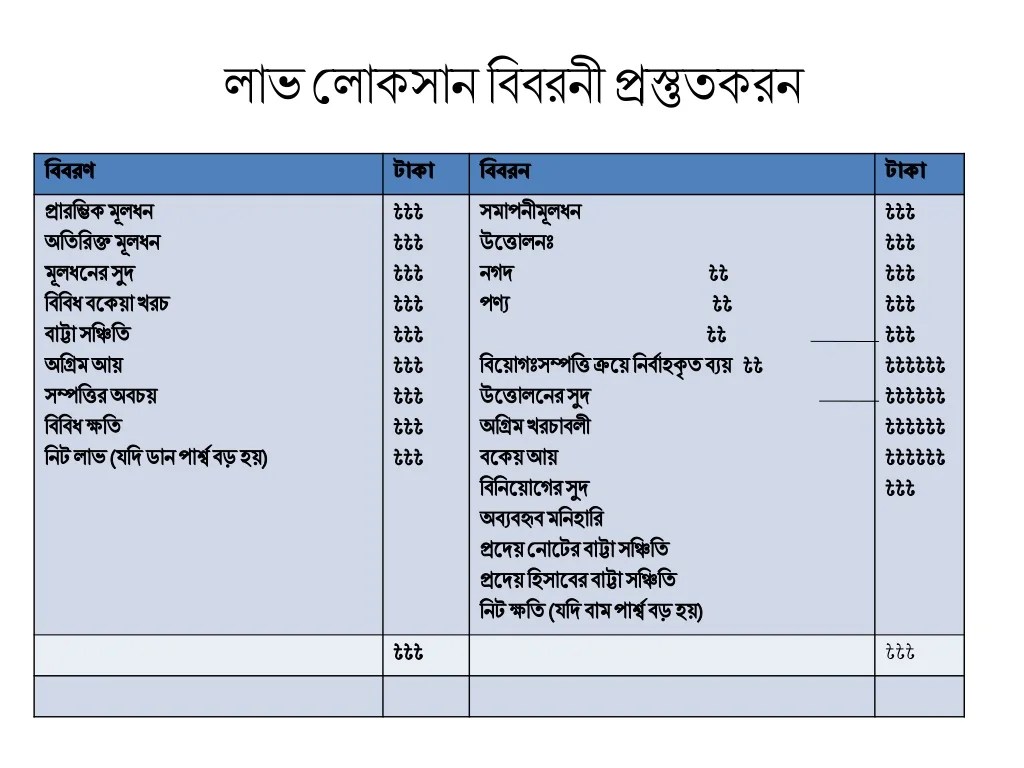

The balance sheet is a financial statement that provides a snapshot of a company’s financial position at a specific point in time. It shows the company’s assets, liabilities, and equity. Assets are resources owned by the company, while liabilities are debts owed by the company.

Equity represents the residual interest in the company’s assets after deducting its liabilities.

Structure and Components of the Balance Sheet, Accounting chapter 10-9 answer key

- Assets: Current assets (cash, accounts receivable, inventory), non-current assets (property, plant, and equipment)

- Liabilities: Current liabilities (accounts payable, short-term debt), non-current liabilities (long-term debt)

- Equity: Share capital, retained earnings

3. Analyzing Financial Ratios

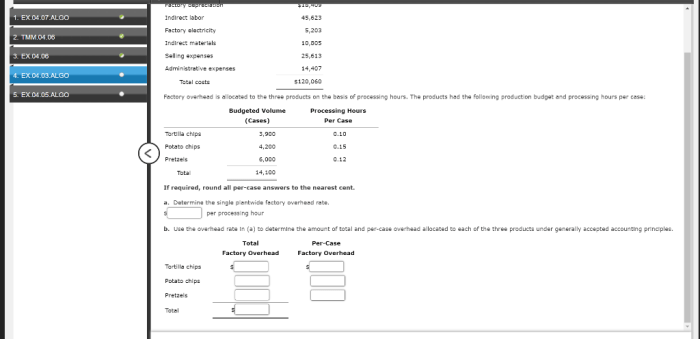

Financial ratios are mathematical calculations that compare different financial statement items to provide insights into a company’s financial performance and condition. Common ratios include liquidity ratios (current ratio, quick ratio), solvency ratios (debt-to-equity ratio, times interest earned ratio), profitability ratios (gross profit margin, net profit margin), and efficiency ratios (inventory turnover ratio, days sales outstanding).

Limitations of Financial Ratios

- Ratios can be distorted by accounting practices or industry norms

- Ratios should be compared to industry benchmarks or historical trends

- Ratios may not be meaningful for all companies

4. Statement of Cash Flows

The statement of cash flows shows the changes in a company’s cash and cash equivalents over a period of time. It is divided into three sections: operating activities, investing activities, and financing activities. The statement of cash flows provides insights into a company’s ability to generate cash, invest in its operations, and repay its debts.

Importance of Analyzing the Statement of Cash Flows

- Assesses a company’s liquidity and financial flexibility

- Identifies sources and uses of cash

- Evaluates a company’s ability to meet its financial obligations

Q&A

What is the significance of the balance sheet in accounting?

The balance sheet provides a snapshot of a company’s financial health at a specific point in time, revealing its assets, liabilities, and equity.

How can financial ratios help me analyze a company’s performance?

Financial ratios offer valuable insights into a company’s liquidity, solvency, profitability, and efficiency, allowing you to compare its performance to industry benchmarks.

What are the key components of working capital management?

Working capital management involves managing a company’s current assets and liabilities to ensure it has sufficient liquidity to meet its short-term obligations.