Dominic earns 285 per week – Dominic earns $285 per week, and this comprehensive guide will delve into the intricacies of his financial journey. From budgeting and saving strategies to debt management and investing for the future, we’ll explore the essential steps Dominic can take to achieve financial success.

With a focus on practical advice and real-world examples, this guide will empower Dominic to make informed decisions about his finances and secure his financial future.

Income Breakdown

Dominic’s weekly income of $285 can be broken down into several components, each representing a different source of earnings. These components may include:

Salary or Wages

This is the fixed amount of money that Dominic receives from his employer for the work he performs. It is typically paid on a regular basis, such as weekly, bi-weekly, or monthly.

Commissions or Bonuses, Dominic earns 285 per week

These are additional payments that Dominic may receive based on his performance or sales achievements. Commissions are usually a percentage of sales, while bonuses are typically awarded for meeting or exceeding specific targets.

Dominic earns 285 per week. With that income, he can consider enrolling in clases de cna en español to further his career prospects. With the certification, he could potentially earn even more than his current salary.

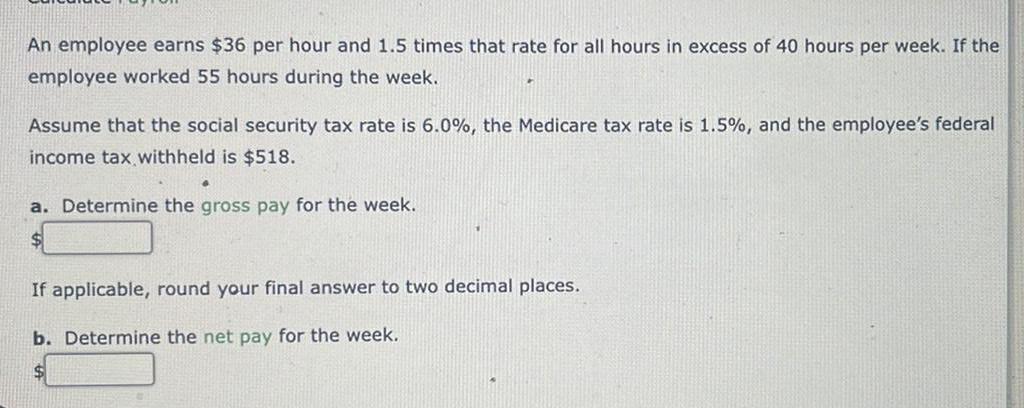

Overtime Pay

If Dominic works more than the standard number of hours per week, he may be eligible for overtime pay. This is typically paid at a higher rate than his regular hourly wage.

Tips or Gratuities

In certain industries, such as hospitality or food service, Dominic may receive tips or gratuities from customers. These are voluntary payments that are not included in his base wage.

Other Income Sources

Dominic may have other sources of income, such as investments, dividends, or rental income. These additional sources can supplement his primary income from employment.

Budget Planning

Budgeting is crucial for Dominic to manage his income effectively. It helps him prioritize his financial goals, track expenses, and avoid overspending. By creating a budget, he can ensure that his income is allocated wisely to meet his needs and achieve his financial aspirations.

Tips for Creating a Budget

- Track expenses:Monitor all income and expenses to identify areas where money is being spent.

- Categorize expenses:Group expenses into categories such as housing, food, transportation, and entertainment to analyze spending patterns.

- Set financial goals:Determine specific financial objectives, such as saving for a down payment on a house or retiring early.

- Allocate funds:Assign specific amounts to each expense category based on priorities and financial goals.

- Review and adjust:Regularly assess the budget and make adjustments as needed to ensure alignment with financial goals.

Tracking Expenses and Managing Debt

To maintain a successful budget, Dominic should diligently track his expenses and manage debt responsibly.

- Expense tracking apps:Utilize apps or spreadsheets to record expenses and categorize them automatically.

- Debt repayment plan:Prioritize debt repayment by focusing on high-interest debts first and consolidating debts if possible.

- Negotiate with creditors:Contact creditors to explore options for lower interest rates or extended repayment terms.

li> Seek professional help:If struggling with debt management, consider seeking guidance from a financial advisor or credit counseling agency.

Saving Strategies

Dominic can implement both short-term and long-term saving strategies to secure his financial future. Establishing clear financial goals and creating an emergency fund are crucial steps in this process.

Short-term saving strategies focus on accumulating funds for immediate or near-term needs, such as a down payment on a car or a vacation. These strategies typically involve setting aside a fixed amount of money each month in a high-yield savings account or a money market account.

High-Yield Savings Accounts

High-yield savings accounts offer competitive interest rates, allowing Dominic to earn a higher return on his savings compared to traditional savings accounts. These accounts are easily accessible and provide the flexibility to withdraw funds when needed.

Emergency Fund

An emergency fund is essential for unexpected expenses, such as medical emergencies or job loss. Dominic should aim to save at least three to six months’ worth of living expenses in a separate account that is easily accessible. This fund provides a safety net during unforeseen circumstances.

Long-term saving strategies are designed to accumulate wealth for future goals, such as retirement or a child’s education. These strategies typically involve investing in stocks, bonds, or mutual funds. Dominic should consider his risk tolerance and investment horizon when selecting investment options.

Investment Options

Investment options for long-term savings include:

- Stocks:Represent ownership in a company and have the potential for higher returns but also carry more risk.

- Bonds:Loans made to companies or governments, offering lower returns but with less risk compared to stocks.

- Mutual Funds:Diversified portfolios that invest in a range of stocks or bonds, providing a balance of risk and return.

Financial Management

Seeking professional financial advice offers several advantages. Financial advisors possess expertise in managing investments and planning for the future, providing valuable guidance to individuals and businesses. They can help you create a comprehensive financial plan that aligns with your goals and objectives.

Role of Financial Advisors

Financial advisors play a crucial role in managing investments and planning for the future. They provide personalized advice tailored to your specific financial situation and goals. They can help you make informed decisions about investing, retirement planning, tax strategies, and estate planning.

By leveraging their knowledge and experience, financial advisors can help you maximize your financial potential and achieve your long-term financial objectives.

Tips for Evaluating and Selecting a Financial Advisor

When selecting a financial advisor, it’s important to consider the following factors:

- Credentials and experience: Look for advisors with relevant certifications and experience in the areas you need assistance with.

- Reputation and references: Check the advisor’s reputation and obtain references from previous clients to assess their credibility and service quality.

- Fee structure: Understand the advisor’s fee structure and ensure it aligns with your financial situation and expectations.

- Communication and rapport: Choose an advisor with whom you can communicate effectively and build a strong rapport.

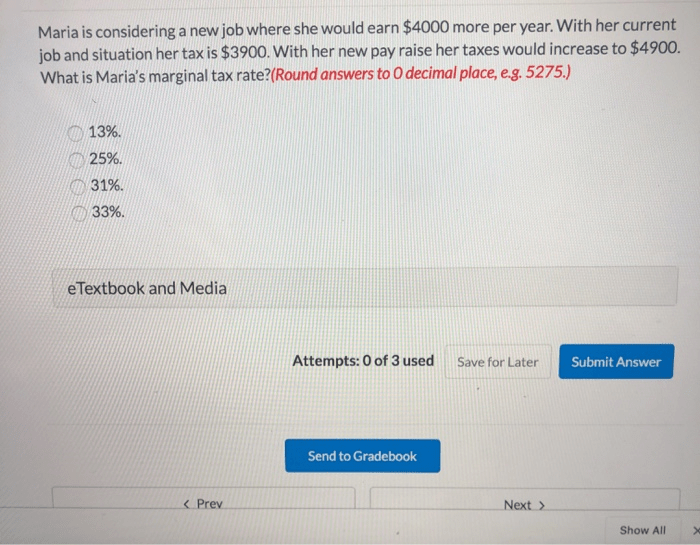

Debt Management: Dominic Earns 285 Per Week

Managing debt effectively is crucial for financial well-being. Understanding the types of debt and implementing strategic repayment plans can help individuals minimize interest payments and regain financial control.

Debt can be categorized into two primary types: good debt and bad debt. Good debt, such as student loans or mortgages, typically involves lower interest rates and has the potential to enhance future earning capacity or increase net worth. On the other hand, bad debt, such as credit card debt or payday loans, often carries high interest rates and can quickly spiral out of control, potentially leading to financial distress.

Debt Consolidation Options

Debt consolidation can be an effective strategy for simplifying and managing multiple debts. This involves combining various debts into a single loan, typically with a lower interest rate. Some common debt consolidation options include:

- Balance transfer credit cards: These cards offer a 0% introductory APR for a limited period, allowing individuals to transfer high-interest debts and pay them off without incurring additional interest.

- Personal loans: Unsecured personal loans can be used to consolidate debt and provide a fixed monthly payment with a lower interest rate.

- Home equity loans: For homeowners, a home equity loan or line of credit can be used to consolidate debt and secure a lower interest rate.

Debt Repayment Plans

Effective debt repayment plans prioritize high-interest debts and establish realistic repayment schedules. Some common strategies include:

- Debt avalanche method: This method involves focusing on paying off the debt with the highest interest rate first, while making minimum payments on other debts.

- Debt snowball method: This method involves paying off the smallest debt first, regardless of interest rate, to gain momentum and motivation.

- Debt consolidation loan: As mentioned earlier, consolidating debt into a single loan with a lower interest rate can simplify repayment and reduce overall interest charges.

Investing for the Future

Investing is crucial for securing your long-term financial well-being. It allows you to grow your wealth over time, outpacing inflation and ensuring financial stability in your future.There are various investment options available, each with its own risk and return profile.

Some popular options include stocks, bonds, mutual funds, and real estate. It’s essential to diversify your portfolio by investing in a mix of assets to mitigate risk and enhance returns.

Diversifying Your Investment Portfolio

Diversification is a key principle of investing. By spreading your investments across different asset classes and sectors, you reduce the risk of losing significant funds due to fluctuations in any one market or sector.Consider investing in a combination of the following:

-

-*Stocks

Represent ownership in companies and offer the potential for high returns but also carry higher risk.

-*Bonds

Loans made to companies or governments, typically providing lower returns but also lower risk.

-*Mutual Funds

Baskets of stocks or bonds managed by professional fund managers, offering diversification and reduced risk compared to individual stock investments.

-*Real Estate

Physical property, such as homes or commercial buildings, can provide rental income and potential appreciation in value over time.

Remember, investing involves risk, and it’s essential to consult with a financial advisor to determine the appropriate investment strategy for your individual needs and risk tolerance.

Clarifying Questions

What are some effective budgeting techniques?

Dominic can utilize various budgeting methods, such as the 50/30/20 rule, zero-based budgeting, or envelope budgeting, to manage his expenses effectively.

How can Dominic save for both short-term and long-term goals?

Short-term savings can be allocated to a high-yield savings account, while long-term savings can be invested in stocks, bonds, or mutual funds.

What strategies can Dominic employ to manage debt effectively?

Dominic can consider debt consolidation, debt repayment plans, or negotiating with creditors to reduce interest rates and improve his debt situation.